Crypto Research

He started the jounrey of crypto research space since 2020 when he was doing internship under barclays and continued improvisation of qunat indicators after the internship with their VP and applied them on crypto trading. He currently executes crypto research for Neev as well as for freelancing.

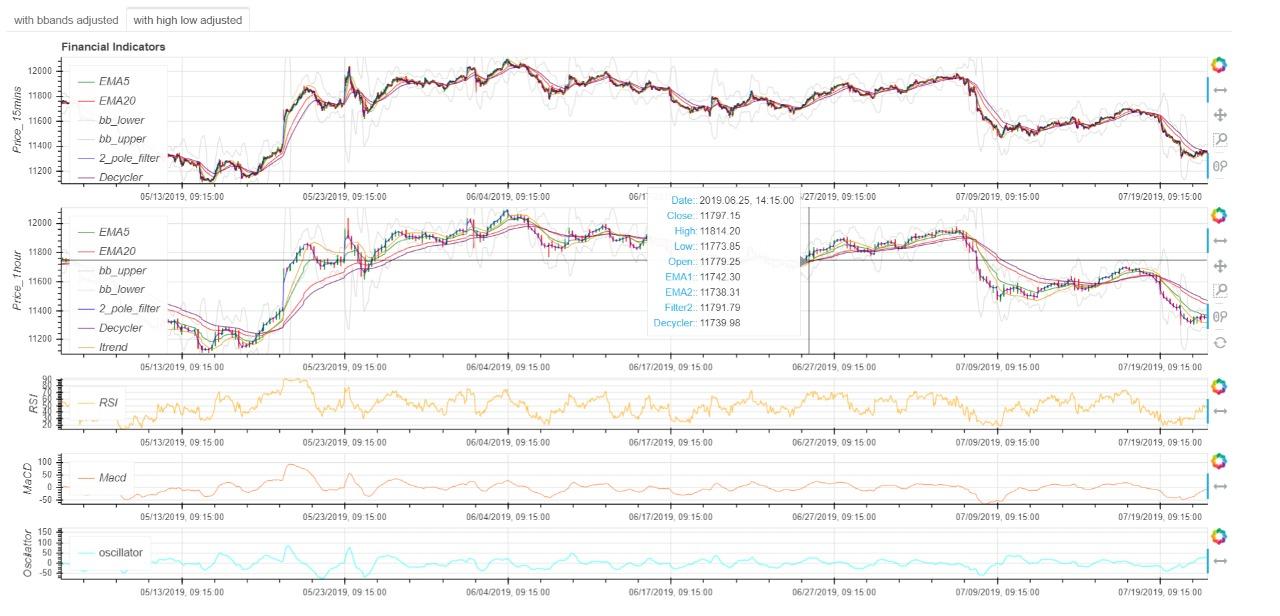

Working Ehlers Indicators:

As a part of Barclays project, he modified, improvised a set of Ehlers cycle indicators into a Python based enviroment with lower latency at execution. As a continuation of the project, he worked with Barclays VP, on side, to implment momentum strategies. The quant modules of indicators were integrated with backtesting system and generated a ROI of 17% on 3 months bakctesting period on 8 digital assets collectively.

Currently working strategies:

-

Pair Trading: Currently experimenting with SOL and AVAX tokens(seems pretty much positively correlated since aug) within a trade testing system with historical data of last 2 months with pair trading strategy with Kalman Filter,i.e, dynamically adjusting their hedging ratio.

-

Trade regime: Trying to ease the Hidden Markov model to achieve maximum accuracy on detecting market trade regime.

-

Market making strategy: Trying to explore marketing making strategies with BTC and ETH perpetual and futures markets, currently with bybit and ETH, it's giving 2-3% return in 16days spread.